Monetary Absurdity

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” – Henry Ford

Even if Henry Ford’s words are over a century old it still has relevance. He was one of many throughout history who had strong opinions about the banking and monetary system. Its mechanisms and history is not a central part of anyone’s education, and it may not be a particular colorful topic to delve into. Still, it is something that affects everyone to a high degree – especially over time – and in some countries more than others.

As covered in some history magazines, there have been several periods where the value of a given currency has fallen drastically. This has typically happened because of the temptation or necessity of printing huge amounts of money by national leaders or bankers. The additional money printed didn’t match the exchangeable assets or real values.

The population takes the economic hit through inflation. The domestic value of money is constantly decreasing, as one soon discovers by comparing known prices from the past with today’s prices. This is supposedly compensated by an increase in salaries by a corresponding percentage. For the same reason, real income of different levels increases differently, and it protects people with high income more against inflation than is the case for low or fixed incomes.

The mechanisms and statistical measurements for inflation are somewhat complex, but as economist Milton Friedman stated in 1970: “Inflation is always and everywhere a monetary phenomenon”. The point being that continuous inflation has historically been connected with continuous increase in the amount of money. The principle is especially well illustrated in countries that have experienced hyperinflation such as Germany in 1923 and Zimbabwe in newer times.

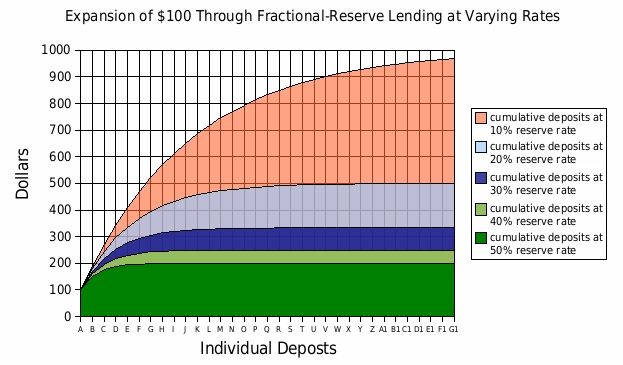

An important aspect is that banks to a large degree lends and demands interest on money they initially don’t possess. “Fractional reserve” means that banks only need to possess, or start off with, a fraction of the amount of money lent to debtors. It was discovered that not all bank customers would demand their savings (or their gold) at the same time. Hence, the banker could print more notes than the physical reserves contained within the vault.

This is still going on, but in more digital ways, as physical notes only constitute a fraction of the values of the monetary system. Most of the money volume is generated through loans, as admitted by several major banks. Hence, the connection between the total amount of money versus manufactured commodities and services is obfuscated. This also invalidates the common belief that banks lend out existing hard-earned money. The question arises: why should institutions get vast revenues from interest on (fictitious) values they don’t possess?

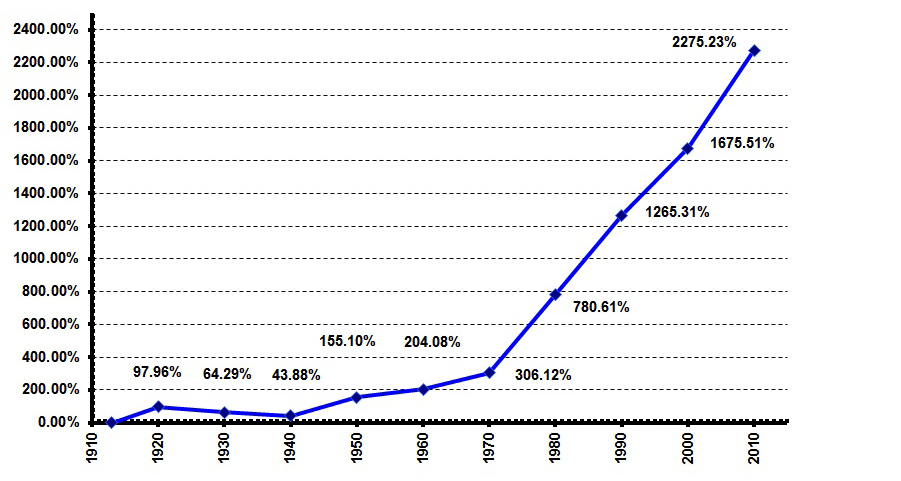

Previous presidential candidate Ron Paul doesn’t hold back on his critics of Federal Reserve (which is neither federal nor has reserves), which functions as the US central bank. He points out that since the founding of the Fed in 1913 the dollar has last 97% of its purchasing power. He also criticizes the lack of audits of the Fed and hidden gigantic loans to European banks after the financial crisis in 2008. Ron Paul describes inflation as taxation that gains Wall Street and states that the Fed has created recessions and depressions in the US economy.

Many claims that the abolition of the gold standard i.e. the standard that made paper notes convertible at a fixed rate with gold bullion, as a central reason to the declining value of money. Since the U.S.’ abolition of the gold standard in 1971, the inflation has skyrocketed till this date. In addition, new ways of measuring inflation have, according to some critics, made the rate of inflation seem lower than it really is. The most important historical factor is still that the “money printer” runs riot when there is a lack of regulation or control of the banking and monetary system.

In November 2014, for the first time in 170 years, a debate on the monetary system was arranged in British Parliament. This was indeed due to the growing distrust towards the system after the latest financial crisis, which the West by no means has escaped. Steven Baker, a British conservative politician, stated the following as a part of the debate’s opening speech:

“We have ended up pretending that bank and financial systems are free markets, while the truth is they are the most hideous corporate mess.”

The more speculative critics of the bank- and money system, such as Max Keiser and Edward Griffin, describes the banking systems as cartels, where politicians and the public in general is victims of the systems draining effect. In cases when banks really should have gone bankrupt, politicians and the public are instead being reminded of the economy’s vulnerability. They are thus forced to transfer values in the order of billions and trillions from the public to the commercial banks. The same values are then being lent back to the public with interest revenues to the banks.

“Never was so much given, to so few, by so many” is a quote in the Norwegian book “DEBT – how the West fooled itself” by Christian A. Smedshaug. The problem with high indebtedness of the households has now escalated to be a problem of high indebtedness on municipal and national level, that is of the public. In addition, a vast amount of money is being created in both the EU and the U.S. through “quantitative easing“, which basically is almost free money to the commercial banks which they can lend out with interest.

A northern breeze was recently sent from the Icelandic parliament toward the banking sector by wanting to fundamentally reform the monetary system. Based on the Research paper “Monetary reform – A better monetary system for Iceland” a proposal is to remove the possibility for commercial banks to create debt money like there’s no tomorrow. Instead, a system is desired where money can only be created in a controlled rate by the central bank, which is regulated by the government, and where revenues to a larger extent go to the State. The growing need for debt is thus being decreased as well.

Like the report diplomatically states under the section “Alternatives to the fractional reserve system”:

“It is tempting to add yet more rules and regulation to the current system hoping to reduce the risks. (…). But ever-more complicated regulation is costly for banks to implement, difficult to monitor and does not remove the fundamental flaws of the system. Rather than attempting to patch a system that has consistently failed, it may be worth considering some alternatives.”

When should a similar debate be held within the Norwegian government? With relatively high revenues from oil and investments in foreign funds, Norway is in a good position to do some clever adjustments to the system which could gain the nation and obtain long-term sustainability. On a higher level, the debt and interest-based money system ought to be reformed globally, since bubbles, budget deficits, indebtedness, scams, and financial crises are indirect causes of its Construction. Unfortunately, strong powers desire to sustain today’s’ system. Yet, the beginning of improvement is a collective consciousness surrounding the system’s absurdity and constructed vulnerability.